Before we explain the 5 major differences between savings and investments, let’s establish that they are pretty much like siblings. They are both great for building a sound financial background, and a future of financial stability. Nonetheless, savings and investments have very unique differences and can be used to achieve diverse financial results.

As you start your journey towards financial freedom, it is essential to know the difference between savings and investments. On that note, what are the key differences between savings and investments and how do we make the most of both?

5 differences between savings & investments

The differences between savings and investments are mostly determined by various factors including the level of risk that it entails. Before we bore you with hints, let’s get into the gist.

- Purpose

It’ll be pointless if we talked about the differences between savings and investments without conveying that they both serve different purposes. Savings are typically funds that are set aside for a short-term or immediate need, such as an emergency fund, a down payment on a house, or a vacation. Investments, on the other hand, are designed to grow your money over the long term, with the purpose of earning returns that exceeds inflation.

- Risk

As we said earlier in the article, one of the factors that set savings and investments apart is the level of risk. Savings are considered to be low-risk investments because they typically involve depositing money in a savings account or a certificate of deposit (CD) at a bank. In contrast, investments carry varying levels of risk, depending on the type of investment, such as stocks, bonds, mutual funds, fixed deposits or real estate.

- Return

Savings accounts typically earn interest at a rate of 1% to 2%, while CDs offer slightly higher interest rates in exchange for a fixed-term commitment. Investments, however, can provide much higher returns, with the potential for significant gains, but also come with the risk of losing money.

With Renmoney, we stay above the clutter of basic savings with RenFlex by giving you daily interest of up to 10% p.a on your money. You also enjoy the freedom to withdraw whenever you want without paying extra charges or reducing your interest. Talk about saving smart and RenFlex should immediately come to mind.

- Liquidity

Another prominent difference between savings and investment is liquidity. Savings accounts and CDs are generally considered to be very liquid, meaning you can easily access your funds when you need them. Investments, on the other hand, may require more time and effort to sell or liquidate, which may impact your ability to access your money promptly. Investments work best when you’re ready to exercise patience and commit to your agreed period of investment.

- Diversification

Savings accounts and CDs typically offer little to no diversification, as they are invested in a single asset class, such as cash or fixed income. Investments, however, can offer greater diversification by investing in a variety of asset classes, such as stocks, bonds, and real estate, which can help reduce risk and potentially increase returns.

In today’s age, investments are now really hands-on. You can choose an investment partner on your smartphone, like RenVault, make a deposit for up to 12 months and watch your money accrue interest of 18% without fluctuation or failure.

Difference between Renmoney Savings and Deposits

Now that we’ve explained the difference between savings and investments generally, let’s help you understand the difference with us.

With Remoney, savings and investment take an ‘interesting’ turn, literally. We mean, you earn interest whether you decide to save or invest. There are, of course, major differences so let’s take you through them as simply as possible.

3 Differences between Renmoney Savings and Investments

- Product Name

You didn’t think we’ll give our savings and investment product the same name did you? Well if you thought we did, you’re correct.

Lol, just kidding.

Although our product names have a similar ring to them, they are very different names. Our savings product is called RenFlex, because saving is a flex with Renmoney. Our investment product, on the other hand, is called RenVault. Similar ring uh? We called it.

- Interest rates differ

RenFlex and RenVault are, as you know, savings and investments products respectively so they cannot accrue a similar interest rate.

With RenFlex, you get an interest of up to 10% p.a. daily, while RenVault earns you a whopping 18% p.a.

- Withdrawals

Withdrawing on Renlex is pretty sweet if we do say so ourselves. You enjoy the freedom to withdraw whenever you want without extra charges like conventional savings accounts would charge. You also don’t disturb your daily interest by withdrawing when you choose.

RenVault is a lot different in this aspect as it needs a little more commitment. You’re not advised to withdraw from your RenVault even though you can depending on emergencies. Why? Because you’re at risk of losing your interest. If it’s not for an emergency, try exercising some patience to enjoy your 18% to the fullest.

Looking to start a RenFlex or RenVault? Download the app here and you’ll be all set.

How to open a RenFlex

Here are 6 simple steps to start your RenFlex savings account and enjoy 10% p.a. and zero charges on withdrawals

- Download the app from your Play Store or App Store

- Create an account

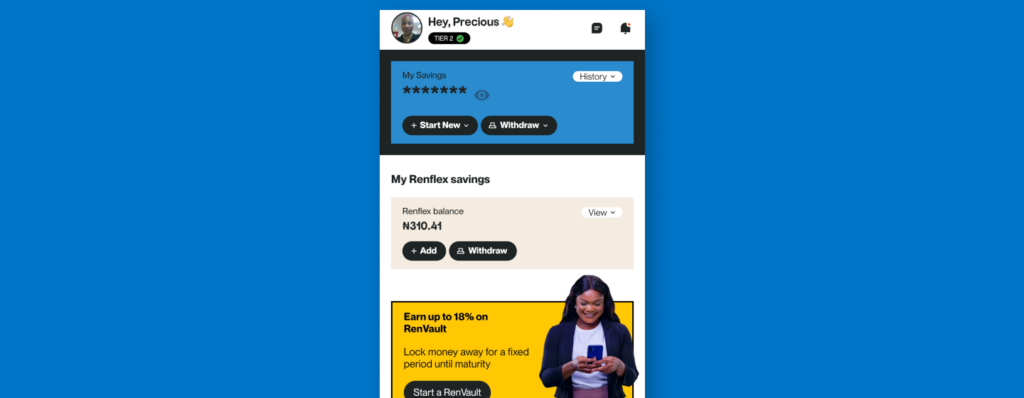

- Tap the “save” icon at the bottom of the screen

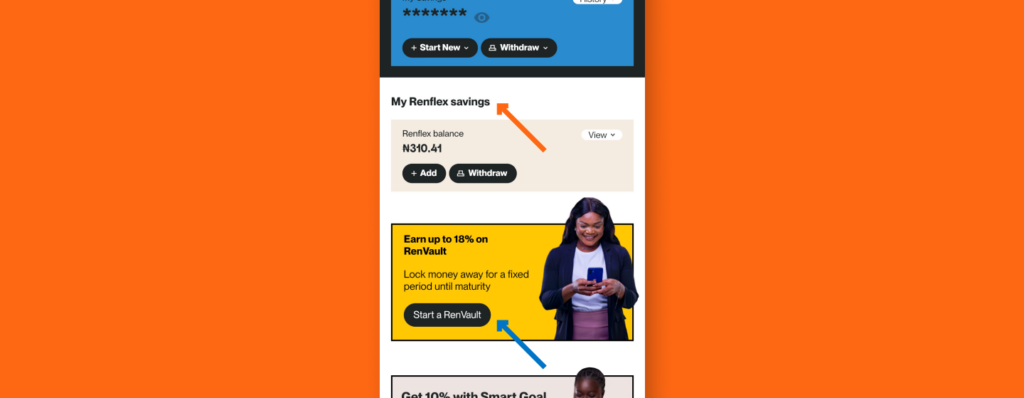

- Under RenFlex savings, tap “add”

- Save as low as N100 and more

- Enter your pin to save your money

How to open a RenVault

Here are 6 simple steps to start your RenVault savings account and enjoy 18% p.a.

- Download the app from your Play Store or App Store

- Create an account

- Tap the “invest” icon at the bottom of the screen

- Click “Start a RenVault”

- Start your investment with as low as N10,000 and input the length of the investment

- Enter your pin and your deposit is successful

You’re good to go!

Conclusion

Understanding the difference between savings and investments is key to achieving your long-term financial goals and understanding the difference between a Renmoney savings and investments (RenFlex, RenVault) is key to choosing the best financial tool to grow your money. Knowing the difference puts you on a great start.

Set up your RenFlex and RenVault in minutes and let’s put your money on the track for growth.

4 thoughts on “5 major differences between savings & investments”

Hi,

Wanted to know what account will be best if I invested NGN 50M ,and only withdraw the interest monthly?

What will the interest be after 30 days?

Thanks

Hi there, We’re sorry for taking this long to get back to you.

Please send a mail to [email protected] for more information.

This site is fabulous. The radiant material shows the essayist’s enthusiasm. I’m dumbfounded and envision more such astonishing material.

Hello there, thank you for reading our post and for your positive feedback!